Introduction to Bank Mergers and Trends

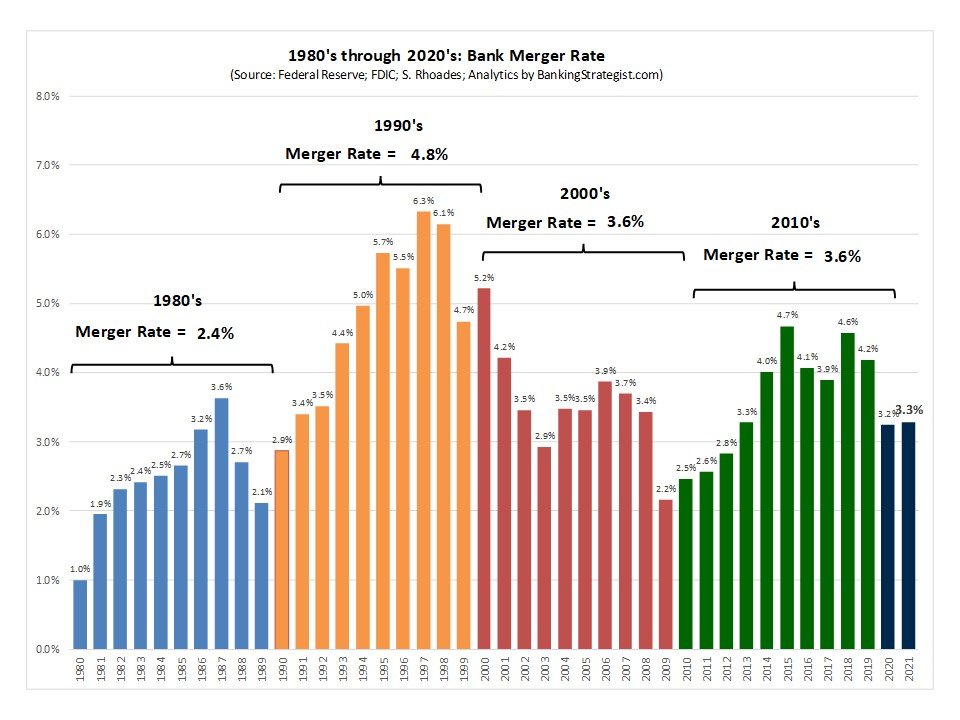

Financial institutions and Banks have scaled to great sizes and beyond borders what one could fathom. Mergers and Acquisitions have been the prevalent vehicle that have taken banks across the globe. The last two decades have seen the same merger rates and is anticipated to go steady if not higher. Based on the economics and investment scenario, the merger rate can vary from year to year. The below chart shows the merger rate over the past four decades.

Mergers of banks have been happening for many decades now. Based on the economic scenario such as GDP growth and financial stress in the banking industry, the merger rate has been fluctuating between 1% to 6.3.%. The past trend was that with increasing GDP growth, the merger rate goes up. Post COVID-19 , with GDP growth bouncing back across countries, more bank mergers might be considered for taking advantage of the economic growth scenarios. For further reading on bank merger trends, please refer to “Bank merger trends” article

Many benefits have been drawn from banking mergers and acquisitions, in terms of increasing lending capacity, stronger, balance sheets, better operational efficiency and better management of capital. However, another important aspect would be to focus on the customers by providing the best products, operational systems, customer service etc.

Let us call the merged entity as ‘Onebank’. Apart from branding and promoting the merged entity, rationalizing the best products have to be given strong focus across every banking portfolio like retail banking, corporate banking, wealth management, global markets, payments, risk & compliance, human resources etc. Further, onebank shall bring the operational and customer service systems to be amalgamated for the merged banking entity. For a seamless and improved experience for the banking customers, onebank shall consider selected end user representatives to test and rehearse the working of the merged entity thoroughly before it is rolled out to the unified customer base. This whitepaper describes a proven methodology that may be adopted.

Goal of This Article

The goal of this article is to outline the steps to be followed in amalgamating the operational systems and customer service successfully. The process outlined here targets minimizing the merger’s impact to the banking customers in the post merger time. The customer shall experience a smooth transition of all his banking products, while experiencing a better value and customer service from the merged banking entity.

Strategy & Process

To achieve the above stated goals, a five phased strategy may be considered.

1. RGB operational stack readiness

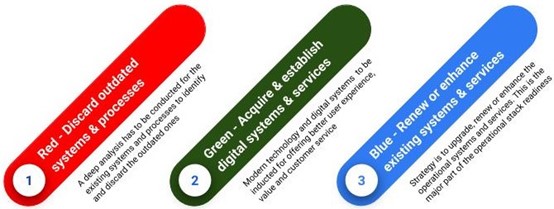

The process recommended is to develop an operational stack including the IT systems for supporting various banking products offered by the merged bank. The suggested strategy is to identify the good and bad from the pre-merger entities and combine them into a single target infrastructure for the merged entity.

2. Data migration

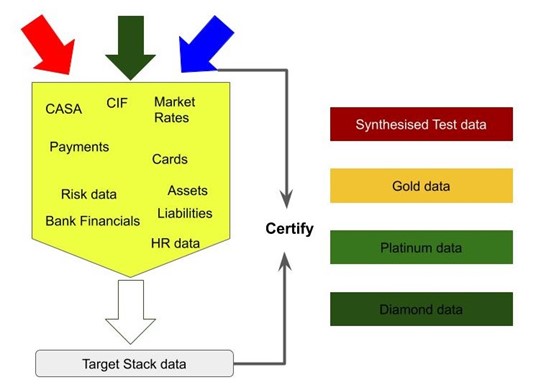

Data migration is another important aspect of the go-live of the merged bank. The data from the pre-merger entities must be transformed and certified to match the target stack of the merged entity.

Starting with the process of product normalization, customer data rationalization etc., the data migration team must define various rules of transformation and logic to validate the data in the target stack. The data migration team also must set up a process for data validation, certification audit and generate reports to be made available to various stakeholders including the internal, external audit, central regulatory authority etc.

3. Operational System integration

The process of operational systems integration shall be done as various operational systems are developed, customized and/or configured to serve customers with the new offerings of the merged banking entity. When the operational systems are ready, it would be mandated to integrate the synthetic data into the respective operational systems and test the endpoints of integration with other systems. Processes shall be established at system level and user level support services by setting up a support desk. This support desk shall develop standard operating procedures for the merged entity.

4. User Acceptance Testing

The strategy for user acceptance testing (UAT) are as follows:

- Testing of operational systems and impacted product/ services/ functions

- Testing of migrated data for accuracy and appropriate fitment into data buckets in the target stack.

- Certify the target stack for the merged entity with new data and the migrated data to work in harmony.

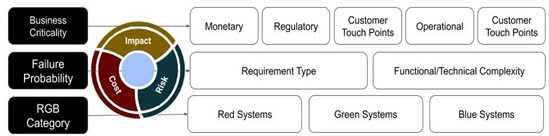

Risk based testing may be adopted as one of the preferred methods for the UAT process. This is based on the operational system assessment in line with the complexity of business, failure probability, new or upgraded functionality requirements impacting the user journey.

5. Dress rehearsal

Dress rehearsals are the first point of selective onboarding of customers to assess the target stack performance. The strategy here is to open the new target operational system parallel with the pre-merger bank systems. Dress rehearsal can also be initiated portfolio-wise. This process should be time boxed with clear exit and go-live criteria. The process starts with identification of specific customers, communicating the impact, accepting willingness to validate the merged entity user journey and experiences. The inter-bank interfaces and payment systems are verified by associating with buddy banks.

Plan & Execution - Bank Merger Program

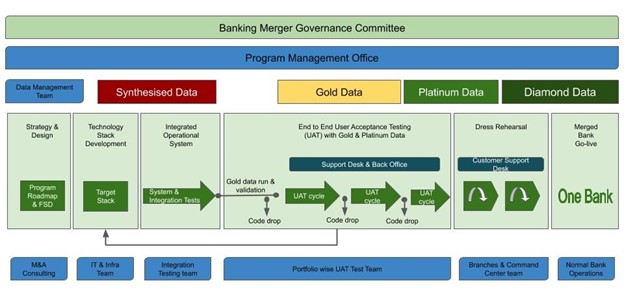

Planning and executing bank merger program is a very complex management exercise. There are lot of moving parts and many stakeholders. These stakeholders are not only from the banks being merged but also outside the bank such as central regulatory authority, buddy banks, cards etc. Below picture is a high-level view of the program management view of the plan of execution.

The main teams involved in this program are

- Merger Governance Committee (MGC) – MGC is the appellate authority to approve rules and regulations of the merger. All aspects of the merger including legal, regulatory, financial, operational, risk management and program management, to name a few, may be periodically reviewed and decisions to be taken and communicated through the Program Management Office (PMO) to across the merger team. MCG shall include central bank and associated bank (sometimes called as buddy bank in a merger scenario) representations. This committee is generally chaired by top management executives such as the CEO or CIO of the merged entity.

- Program Management Office (PMO) – PMO team is responsible for planning, tracking, reporting and coordinating across various teams involved in the merger program and all the stakeholders involved. PMO shall be primarily responsible for tracking the “Onebank” plan execution by coordinating across teams, keeping the communications from MGC and cross teams, Tracking and reporting progress and milestones, Keeping track of evidence for future regulatory audits etc.

- Merger and Acquisition (M&A) strategy consulting team – Once the bank merger is finalized this team start with defining the Goals, business case and business requirements that drive the M&A program.

- IT and Infrastructure team – This team is responsible for managing and maintaining all IT hardware and software including the IT infrastructure, banking electronic outlets like automated teller machines (ATM), point of sale (POS) machines, card systems, core banking platform, back end financial and other processing systems, analytical and governance reporting systems, monitoring and risk management applications, human resources, procurement applications, etc.In creating a onebank, IT and Infrastructure team take a major role in building the backbone of the banking system to process customers transactions, associated regulatory and governance requirements. It’s important for them to understand the end goals of how businesses conceive and service the various banking products to its customers so that the experience of bank customers can be greatly improved, and the various processes of product servicing can be greatly simplified. For Onebank roll out, few of the subfunctions like the Identity and access management (IAM), Data and migration, application integration etc are very critical for the success and may need to be extended beyond the normal working hours of the bank. Hence it is important to ramp up capacity of these sub functions to gear up for the onebank roll out

- Integration Testing team – Integration Testing Team is constituted to technically test all the features, functionalities and integrations of Banking platform infrastructure and platform.

- User Acceptance Test (UAT) team – This team is structured portfolio-wise for testing the various products and services from the onebank. To perform a successful UAT program, subject matter experts (SMEs) from various products and services are brought into a team to work dedicatedly for validating and approving the system functionalities to provision banking product related services in an efficient and simplified manner while offering the highest customer experience from onebank. After the Integration testing team has completed the technical level testing of banking testing and integrations, the UAT team receives code drop and golden data for conducting the UAT. Apart from the portfolio wise UAT team, following teams but not limited to, are constituted to complete successful UAT program

- UAT test management team – This team help to define and

coordinate all testing - UAT bank support desk team,

- Data validation and certification team,

- Back-office support and bank reconciliation team

- UAT test management team – This team help to define and

- Customer Support Desk team – On successful completion of UAT a Dress rehearsal to go live is performed with a selected set of customers, branches and back-office system functioning parallel to the premerger bank(s). During the dress rehearsal phase a customer support team is ramped up to support the customers and branch staff will be involved in the dress rehearsal. This team is highly trained and equipped with standard operating practices (SOPs), workarounds and support procedures to quickly turnaround the issues reported by customers and branches.

- Branches and command center team – Selected branches are set up to perform banking transactions across various products and services as a regular banking activity. The activities across branches, buddy banks, merchants, affiliates and central banks are monitored and coordinated by the command center team. All the issues were flagged by the command central team and reported to PMO and MGC for escalations and halt the dress rehearsal if needed or Onebank go-live to their customers may be done.

Risks & Mitigations

| Risks | Mitigations | Preventive Actions & Remarks |

|---|---|---|

| Increase in customer attrition/switching after the merger | Understand the customer needs from Onebank, the merged entity and drive the M&A strategy in line with expectation and attract more customer | Implement best of the breed products and services that were bringing customers from each of the merged entities. |

| Lack of Onebank’s (merged entity) capability to offer unique and innovative banking products for the customer base. | Constantly seek to fill customer needs and innovate products based on past customer experiences from both the banks being merged | Banding of products and services from the newly formed Onebank. Communication to customers on the branded products and onboarding the customers to the new offerings from Onebank. |

| Inability of Onebank’s (merged bank) processes, systems, and staff to serve customers with the new products and services. | Onebank to create a single stack of banking applications, mapping all the products and processes to service their customers. All the banking staff to be trained in the new stack and ready to service customers before onebank is launched. | Having a well-defined data strategy for Onebank is absolutely the key success factor for launching onebank. This needs to be well defined and integrated across banks and not siloed. |

| Inadequate integration of the Onebank into the larger national and international banking ecosystem | Evolve partnership with other players in the banking and nonbanking service providers to serve customers using automated and efficient ways to enhance the banking experience with onebank. | Involve Buddy Banks (Banks which have close working relationships nationally & internationally), agents, resellers, merchants, partners etc. |

| Inability of the Onebank to follow all regulatory compliances and audit requirements. | Consider having regulatory framework compliance and further auditing as part of the merger initiatives. Capture and record impacted areas of merger for frequent review with the banking regulator and record for future audit needs. | As the customer base is increasing and new products being introduced it would be important to implement better fraud detection, anti-money laundering (AML) etc. |

Stakeholder Communication

This specific section is included considering the very importance of stakeholder communication especially to the customers of both the banks that are being merged. This shall start from the moment the merger is announced. A merger communication team shall be formed as part of the PMO. All communication across all stakeholders shall be based on a well-drawn-out strategy. The strategy shall be comprehensive to guide the communication process across all phases and levels in the merger process. This team shall organize periodic announcements through various channels based on the nature of communication. All the communications shall be presented to the MGC and if needed, to the onebank’s executive board before the announcements. It would be also important to take feedback from the stakeholders to pivot or adjust during the merger process.

Conclusions

The bank merger needs to be considered as an organization change management initiative which not only affects the investors and employees but also the outside stakeholders. The impact of this is of great concern to bank’s customers as their lives and business are associated with the success of the merger. It is important to include attributes of customer impacts in defining goals and critical success factors for the bank’s merger. It is important to have a well-defined governance process to measure customer impacted areas and items like the few mentioned below

- product and services,

- integration into banking ecosystem,

- Branches and other banking channels,

- well-connected customer care,

- having an effective technical stack,

- Data migration and management

- Communication strategy

- Governance and compliance

There were many bank mergers and acquisitions in the past and many more to happen in future. It is important to learn from our past and add to our learning to make more successful ones in the future.

Thank you so much for reading. Hope you enjoyed and learned from it.